Blockstar Blog: Curve and Uniswap

What are the key differences in use cases and user bases for the top two decentralized exchanges?

Facilitating over 79% of the total DEX market share by volume are just two protocols: Curve Finance and Uniswap. Both protocols leverage the AMM (automated market maker) architecture that made DEXes so popular, charging anywhere from .01-1% on a trade. Additionally, each decentralized exchange has their own native token, UNI in the case of Uniswap and CRV for Curve Finance. But that’s where the similarities end. Although these are both DEXes, they have evolved to cater to very different audiences for specific use cases. For Curve Finance, the argument can be made that the protocol is designed for more sophisticated users like DAOs or larger “whale” traders while Uniswap caters to the everyday trader. Below the differences between each protocol will be highlighted and the user bases will become clear.

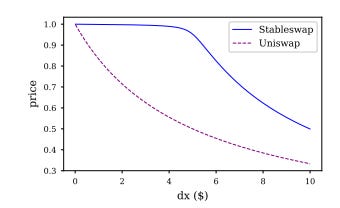

To begin, Curve was designed for extremely efficient stablecoin trading, allowing for deep liquidity and low slippage. Curve realized the traditional constant product pricing algorithm did not work the best for stablecoin swaps and thus the stableswap algorithm was created. As a result, when comparing the coins listed for trading on Uniswap versus Curve you will notice most coins listed on Curve are like-assets meaning they’re supposed to trade at the same price: DAI/USDC/USDT, FRAX/USDC, ETH/stETH, renBTC/wBTC. Furthermore, the user interfaces for Curve and Uniswap differ drastically. Uniswap’s user interface is extremely simple just displaying the asset you have and the asset you want to swap to while Curve displays the yields of different pools.

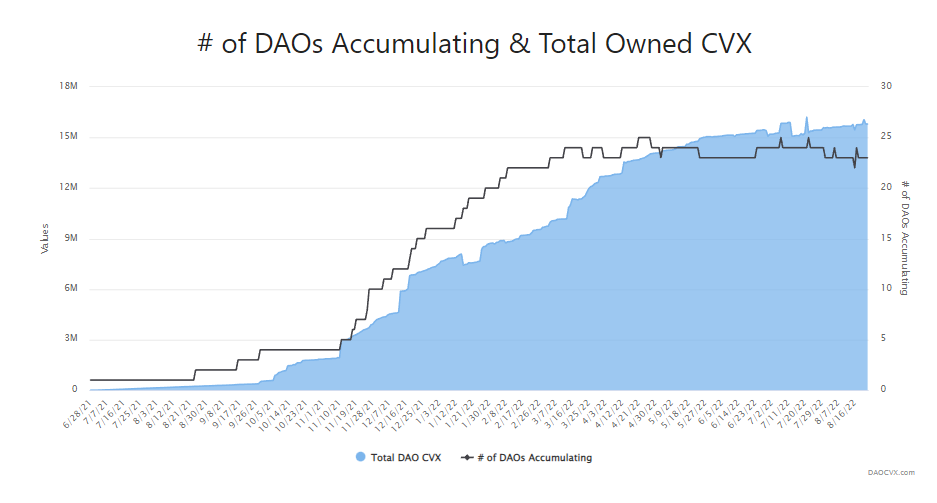

The most glaring difference between these two protocols is the functionality of their native token. In the case of Curve Finance, by staking their native token CRV you are entitled to a pro rata share of 50% of the fees earned by the protocol. Currently, with Uniswap there is no way for token holders to earn a share of protocol fees, although this is something that could potentially change in the future. Additionally, the token emissions for each protocol vary significantly as well. In the case of Uniswap, future token emissions are split among the team, investors, advisors, and the majority are sent to the community treasury that is governed by Uniswap token holders. These token holders can vote to use UNI towards grants, strategic partnerships, governance initiatives, and additional liquidity mining pools. For Curve, most of the future token emissions are distributed to Curve liquidity providers, according to measurements taken by the gauges. What this means is that every 10 days CRV stakers can vote on where to direct future CRV emissions. So, what has happened historically is that the gauges that receive the most votes receive the most CRV emissions which translates to a higher yield and in turn the most liquidity. This ability to direct token emissions, and ultimately direct liquidity, has become incredibly valuable. In fact, there have been markets built around bribing CRV stakers for their votes. For example, Votium allows users to bribe for gauge votes and to date has seen over $217M in bribes.

Well, who is participating in this bribe market? The participants are DAOs/protocols that want to direct CRV emissions to their liquidity pools to increase potential yields and ultimately increase their pools liquidity. This has been incredibly important for stablecoin protocols that want to increase their liquidity and peg stability as well as new DeFi coins that want liquidity for their native token. As presented in the chart above, there are now 24 DAOs accumulating CVX which has 5.45 CRV locked per CVX. This sophisticated bribing market has made it cheaper for protocols to attract liquidity using CRV emissions rather than their own native tokens emissions, greatly reducing the negative impact of native token inflation. To further support the notion that Curve is utilized by larger entities, one analysis completed in December of 2021 saw that the average trade size on Curve was between $500,000-$1,000,000 while the average trade on Uniswap and other competitors was in the range of $10,000-$20,000. Both of these protocols have proven their ability to facilitate decentralized trading for cryptocurrencies while catering to different audiences. Moving forward it will be interesting to see how these protocols evolve and where they direct their efforts to attract more traders and higher trading volumes.