Blockstar Market Update: September 6, 2022

Ethereum merge inches closer, AAVE pauses $ETH lending, Saudi Arabia hires Digital Assets Lead, PANONY raises Series A

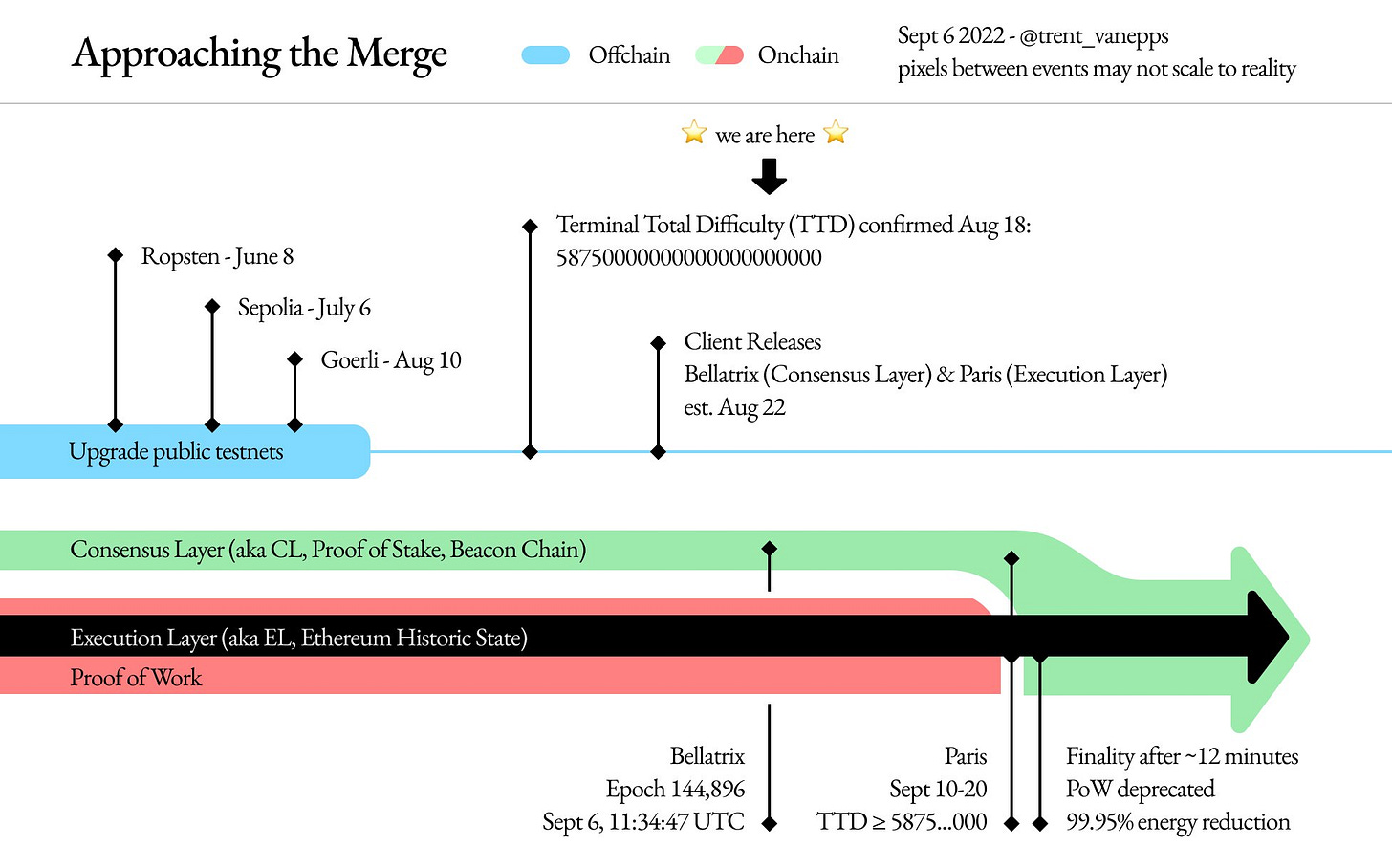

The Merge. That’s all crypto investors are talking about this week as the much anticipated transition from proof-of-work (PoW) to proof-of-stake (PoS) is now just 8 days away. The mere prospect of the merge is sending shockwaves throughout the industry as Ethereum Classic miners prepare for a post-merge reality; $ETC price and hashrate rose as a result. Additionally, AAVE paused all $ETH lending, signaling broader industry-wide uncertainty. However, uncertainty didn’t stop everyone as seen with Saudi Arabia and PANONY. Overall, uncertainty is certainly the overarching theme of this week’s Blockstar Market Report.

Key Takeaways:

The Merge is now only 8 days away, as the entire industry waits to see the outcome

Bellatrix, the final upgrade before the official merge, has taken place

AAVE pauses Ether lending ahead of the merge

Saudi Arabia hires Virtual Assets and Digital Currencies Lead

PANONY raises Series A funding, valuing the web3 incubator at $100m

Total Crypto Market Cap (CoinMarketCap): $995.97B (+2.68% 7d)

Total Crypto Market Cap Ex-BTC (CoinMarketCap): $615.22B (+4.29% 7d)

Ethereum Merge Inches Closer

The Ethereum Merge is just over a week away now, and the industry is anxiously awaiting. The success of the merge, or lack thereof, could change the landscape of the industry as a whole. With billions of dollars of value locked up and tens of thousands of developers tied to the ecosystem, the merge is all anyone in web3 can focus on. As a result of the switch from proof-of-work (PoW) to proof-of-stake (PoS), the need for Ethereum mining will essentially diminish. On the bright side, energy consumption related to Ethereum mining is expected to decrease by 99.95%, however the need for miners will also decrease, doing away with a large portion of the decentralized ecosystem. Consequently, Ethereum miners have begun to look at alternative options for use for their mining facilities, including Cloud and AI services, in addition to participation with Ethereum Classic, the 2016 fork from Ethereum which is expected to retain a proof-of-work consensus mechanism. ETC’s hashrate reached over 48.64 terahashes per second (TH/s) as of Tuesday morning, a 133% increase since July.

Additionally, the Bellatrix hard fork, the last remaining update before the merge, was successful executed today, signaling to investors that the development team remains on track.

$ETH: $1,659.41 / 24h: +4.03% / 7d: +11.22%

$ETC: $41.03 / 24h: +12.58% / 7d: +29.45%

AAVE Pauses $ETH Lending

Amidst worries that borrowers will over-leverage their ETH positions, the DeFi lending giant, AAVE, has paused loans on ETH in an effort to reduce the exposure risks to investors. The move, which was voted on by the AAVE community over the weekend, somewhat contradicts the free market establishment that decentralized finance stands for. However, the aspect of decentralized governance proves effective as the community proposal and vote to mitigate lending risks was the popular decision among AAVE holders. Block Analitica highlighted the proposal by saying “Ahead of the Ethereum Merge, the Aave protocol faces the risk of high utilization in the ETH market. Temporarily pausing ETH borrowing will mitigate this risk of high utilization.” More can be read about the proposal and the risk of high utilization rates here.

Saudi Arabia Hires Digital Assets Lead

Saudi Arabia’s Central Bank hired Mohsen Al Zahrani to lead a regulatory team on virtual assets and digital currencies, per a report from Bloomberg. The move comes as the UAE has emerged as the regional crypto hub in the Middle East. Many speculate that competition with the UAE paired with increasing participation in crypto markets has forced the Saudi government to embrace the digital asset revolution and begin to focus on how to regulate the asset class. An April report by Bitcoin.com News highlights that 54% of Saudi residents not only viewed crypto as an investment asset class but also believed that it should be used as currency. Another report highlight recently by the same outlet states that 14% of Saudi residents were current crypto traders. Despite bear market conditions, adoptions en masse will inevitably force governing bodies to adapt and embrace the alternative asset class.

PANONY Raises Series A Funding

Some more bullish news released over the weekend as PANONY, a Hong Kong based Web3 incubator, raised Series A funding, valuing the investment and advisory company at $100m. The fundraise comes during a prolonged bear market that has been fueled in part by a declining global economy and increased security concerns with decentralized technologies. Despite these concerns and conditions, many investors remain bullish on the technology as major money continues to flow into key parts of the industry. PANONY will now look to provide similar help to web3 projects in an effort to further advance and grow the web3 economy.

Other Crypto News

Ethereum Domain Names Top NFTs as Most Traded Asset on OpenSea (Decrypt): https://decrypt.co/109028/ethereum-domain-names-top-nfts-as-most-traded-asset-on-opensea

Renault Inks Partnership with The Sandbox to Bring Automotive Experiences to the Metaverse (Bitcoin.com): https://news.bitcoin.com/renault-inks-partnership-with-the-sandbox-to-bring-automotive-experiences-to-the-metaverse/

KPMG Predicts Crypto Investment Slowdown Will Continue Through Rest of 2022 (Coindesk): https://www.coindesk.com/business/2022/09/06/crypto-investment-slowdown-will-continue-through-rest-of-2022-predicts-kpmg/

IMF Report States Crypto Assets Become More Mainstream (Bitcoin.com): https://news.bitcoin.com/imf-crypto-assets-become-more-mainstream-as-hedges-against-weak-currencies-potential-payment-instruments/