Blockstar Market Update: September 12, 2022

The Merge Week is Here, MicroStrategy sticking to Bitcoin, White House Proposes Ban on Crypto Mining, Starbucks Makes Move into Web3

2 days. Arguably the most anticipated day in crypto’s 14 year history is just 2 days away. The entire industry waits with bated breath as the Ethereum developers get ready to official merge to a proof-of-stake consensus mechanism. The success of the move, or lack thereof, could have ripple effects across the entire industry. As the most popular and developed Layer 1 blockchain, Ethereum’s merge is a pivotal moment in the history of this industry.

In this week’s market report, we’ll look at how traders are feeling ahead of the merge as well as some relevant business and regulatory stories from over the weekend.

Make sure to subscribe below to stay on top of all Blockstar related content and be on the lookout for educational blogs on the merge, as well as research reports on promising web3 projects.

Key Takeaways:

The Merge is just over 2 days away, $ETH and $BTC trades higher ahead of the move

MicroStrategy sells shares to buy more Bitcoin

White House proposes a ban on crypto mining

Starbucks makes move into Web3

Blockstar upcoming content: Proof-of-Work vs Proof-of-Stake Educational Blog, LooksRare Research Report

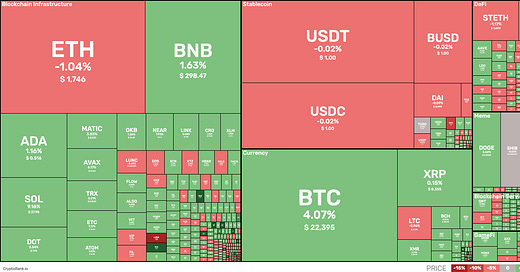

Total Crypto Market Cap (CoinMarketCap): $1.075T (+9.26% 7d)

Total Crypto Market Cap Ex-BTC (CoinMarketCap): $646.07B (+7.19% 7d)

The Merge, ETH Options and The Markets

Excitement about the week of The Merge lead markets higher over the weekend as $ETH is back over $1700 and $BTC crossed $22,000. Traders and investors alike received additional bullish news as the CME group announced the launch of Ether options early Monday morning. Institutional money has been largely focused on two developments of digital assets markets before investing in the industry: an increase in financial instruments to be able to trade and hedge digital asset positions and increased regulatory clarity. As these market drivers develop, it is likely that institutional money will become more involved - an important step to general adoption and market stability.

From a technical standpoint, we are seeing some consolidation on $ETH trades as traders seemingly took some profits after seeing multi-week highs over the weekend. $ETH is still trading above $1700 at the time of this writing. Bitcoin, on the other hand, is continuing to trade higher Monday morning and hasn’t shown much sing of slowing up. Altcoins generally follow Bitcoin’s moves, so some of the smaller market cap tokens (especially those built on the Ethereum blockchain) will be interesting to watch this week.

Bitcoin Levels:

Price: $22,315.04

Support Level 1: $19,901.24

Support Level 2: $18,506.02

Support Level 3: $17,750.85

Resistance Level 1: $22,051.63

Resistance Level 2: $22,806.80

Resistance Level 3: $24,202.02

Ether Levels:

Price: $1,730.21

Support Level 1: $1,651.94

Support Level 2: $1,582.24

Support Level 3: $1,537.35

Resistance Level 1: $1,766.55

Resistance Level 2: $1,811.45

Resistance Level 3: $1,881.16

MicroStrategy Sells Shares, Buying More Bitcoin

MicroStrategy is at it again - this time selling $500m worth of stock with plans to buy more Bitcoin. A recent SEC filing shows the company’s plans to sell Class A shares amounting to roughly $500m. The filing also states that the company plans to buy more bitcoin and further develop its software business.

This is welcome news for Bitcoin traders, who in recent months have seen extensive selling pressure as a result of numerous forced liquidations. Michael Saylor, despite relinquishing his role as CEO, clearly is sticking to his plan to make MicroStrategy a Wall Street leader in holding Bitcoin on its Balance Sheet.

MSTR 0.00%↑ was down early on Monday following the news as many are still uncertain of Bitcoin's short-term volatility.

White House Proposes Ban on Crypto Mining

Earlier this spring, Biden called for a number of government studies focused on cryptocurrency. This most recent proposal targets crypto miners in an effort to reduce energy consumption. It’s widely known that Bitcoin’s proof-of-work consensus mechanism uses large amounts of energy, one of the main reasons why Ethereum is conducting the Merge this week.

In the release from the White House, the Biden administration recognizes the increased use of digital assets (a win for the industry). The administration must now walk a thin line in proposing and passing regulation that makes crypto safer and more widely accepted, without defeating the decentralized purpose of why it was created.

In the release, the White House states “The use of digital assets based on distributed ledger technology (DLT) is expanding…As an emerging technological innovation, digital assets have provided some benefits and value for some residents and businesses in the United States, and have the potential for future benefits with emerging uses.”

They go on to say, “DLT may have a role to play in enhancing market infrastructure for a range of environmental markets like carbon credit markets, though other solutions might work as well or better. The potential benefits of DLT would need to outweigh the additional emissions and other environmental externalities that result from operations to merit broader use, relative to the markets or mechanisms that DLT displaces. Use cases are still emerging, and like all emerging technologies, there are potential positive and negative use cases yet to be imagined. Responsible development of this technology would encourage innovation in DLT applications while reducing energy intensity and minimizing environmental damages.”

This all looks promising, as the White House is recognizing the benefits of digital assets and its growing place in American and global society. It is now up to blockchain developers to follow Ethereum’s lead, and work with our leaders to make crypto more widely adopted.

Starbucks Makes Move into Web3

Starbucks announced early Monday morning its plans to partner with Polygon, a Layer 2 blockchain solution built on Ethereum, in an effort to launch its own version of a web3 product. The proposed web3 experience dubbed “Starbucks Odyssey” will allow Starbucks loyalists a chance to participate in web3 rewards including the ability to buy and earn digital collectibles (NFTs). The proposal states that these NFTs will allow consumers to “unlock new access to new benefits and immersive coffee experiences.”

Starbucks plans to leverage Starbucks Odyssey to break into the web3 revolution and get ahead of its competitors by creating a web3 community supporting its coffee business. The release states, “Once logged in, members can engage in Starbucks Odyssey ‘journeys,’ a series of activities, such as playing interactive games or taking on fun challenges to deepen their knowledge of coffee and Starbucks. Members will be rewarded for completing journeys with a digital collectable ‘journey stamp’ (NFT).” The full explanation from Starbucks can be read here.

Starbucks becomes the latest company to embrace web3 technologies and built platforms for the next generation of consumers. Despite bear markets and months of crypto uncertainty, it’s promising to see companies continue to embrace the technology and join in advancing the industry.

More News Stories

Sam Bankman-Fried On the State of the Industry and the New Venture with Anthony Scaramucci’s Skybridge Capital: https://decrypt.co/109496/everythings-down-this-year-not-just-crypto-ftx-founder-sbf

Ford Files 19 Trademarks in Possible Metaverse Push: https://news.bitcoin.com/ford-files-19-trademark-applications-preparing-a-possible-metaverse-push/

Opinion: There’s No Future for DeFi Without Regulation: https://www.coindesk.com/layer2/2022/09/12/theres-no-future-for-defi-without-regulation/

SEC Sets up Dedicated Office to Crypto Regulation: https://news.bitcoin.com/us-sec-sets-up-dedicated-office-to-review-crypto-filings/

Galaxy’s Novogratz Says Fidelity’s Shift to Retail Coming Soon: https://www.bloomberg.com/news/articles/2022-09-12/galaxy-s-novogratz-says-fidelity-to-shift-retail-to-crypto-soon?srnd=cryptocurrencies-v2#xj4y7vzkg