Blockstar Research Report: Gains Network

Research and analysis on the development team behind one of the industry's most exciting leveraged trading platforms

Gains Network Volume 1: August 2022

Contents

Project Overview

Protocol Outline

Roadmap & Scalability

Tokenomics

Competition & Risks

Team, Partnerships, & Investors

Key Metrics & Evaluation

Project Overview

Gains network is the development team behind gTrade, a decentralized leveraged trading platform that allows users to trade cryptos, forex, and stocks. gTrade offers its users higher leveraged trading options while providing liquidity efficiency and low fees through its advanced protocol mechanics. The platform is built on the Polygon blockchain and revolves around the ecosystem’s native ERC20 token, $GNS, as well as its ERC721 utility tokens (NFTs).

This report will cover how the gains network team has developed one of the more exciting projects in the space and created a functioning decentralized, liquidity efficient, user-friendly leveraged trading platform.

Key Takeaways:

· gTrade offers low trading fees on a wide range of leverages and pairs (150x on cryptos, 1000x on forex, 100x on stocks)

· $GNS token (ERC20) and ERC721 tokens (NFTs) power the ecosystem

· $GNS and NFTs are designed to be actively used within the platform to allow ownership of the protocol through revenue capture and governance

· $GNS holders can use single-sided staking to receive platform fees

Protocol Outline

gTrade Features

The trading experience on gTrade is highlighted by 8 key features that make the product unique to decentralized leveraged trading.

1) Full Custody of Funds: Because of the decentralized nature of the platform, no deposit or signup is necessary. Users maintain full custody of their own funds which must remain in escrow contracts as collateral in order for the trade to remain open

2) High liquidity and low price impacts: gTrade utilizes a stablecoin vault system to provide highly efficient liquidity with low slippage as compared to other decentralized exchanges

3) Median spot prices: gTrade leverages decentralized oracle networks (DONs) to retrieve the most accurate data for settlement purposes. This removes the issue of scam-wick settlements that has been seen on many centralized exchanges

4) Users can trade crypto, forex, and stocks: Since gTrade consolidates data using the DONs and settles PnL all through the DAI stablecoin vault, users can gain exposure to a variety of financial assets

5) Highest leverages available: The liquidity efficiency allows to users to trade up to 150x on cryptos , 1000x on forex, and 100x on stocks

6) Low fees: A standard 0.08% fee is charged on every order

7) Transparent and decentralized: The decentralized nature allows for users to control the experience through community governance

8) Exceptional-user experience: Dev team has focused on creating a user-friendly interface based on over a year of feedback

gTrade Operability

The gTrade platform is built on synthetic leverage that has four main drivers: (1) the DAI vault, (2) the GNS/DAI liquidity, (3) the GNS and DAI staking pools, and (4) the GNS token and NFTs. Trading positions are opened when users deposit DAI into an escrow deposit contract and select their leverage preference and their position.

DAI Vault

The trading process starts when users post DAI collateral in an escrow smart contract that is tied to the DAI Vault. DAI is a stablecoin that is pegged 1:1 to USD. DAI is deposited into the vault in one of two ways: either by liquidity providers or by transfers from escrow deposit contracts on losing trades.

Vault balance = Staked DAI Value + Platform PnL

Vault collateralization % = [(Staked DAI value + Platform PnL) / Staked DAI Value] *100

The collateralization rate on the protocol is 30% (this is subject to change as the result of governance proposals). If platform PnL causes the vault to become over-collateralized (traders are losing more than winning), then DAI will be withdrawn from the vault (to get back to 30%), swapped for GNS in the GNS/DAI liquidity pool, and subsequently burned. If the platform PnL causes the vault to become under-collateralized (traders are winning more than they are losing), GNS would be minted and swapped in the GNS/DAI pool for DAI, which would then be added back to the vault to maintain a 30% rate.

On losing trades, the DAI collateral is assumed by the vault, whereas on winning trades, PnL is paid out to traders directly from the vault.

GNS/DAI Liquidity

The GNS/DAI liquidity pool allows users to swap between GNS and DAI in a decentralized environment. Digital asset investors buy GNS to hold, trade, or stake. The liquidity pools also enables the protocol to maintain appropriate collateralization rates, as mentioned above.

Staking Pools

In order to incentivize liquidity providing and the subsequent creation of liquidity efficiencies, the gains network created staking pools for DAI and GNS tokens. Users who stake DAI and GNS each have claims to the fees generated from the DAI vault. However, there are pros and cons to each.

Staking DAI: DAI is a stablecoin and therefore there is no exposure to currency fluctuations. In case of massive loss, DAI stakers would lose their position since DAI is paid out of the vault, not GNS. In return, DAI stakers get a larger percentage of fees accrued from the vault.

Staking GNS: GNS stakers also receive a portion of the fees generated from the vault, however GNS acts as a backstop to the protocol (if the vault is running low on DAI, GNS protocol reserves will be sold to add DAI back) in addition to providing governance power and fee generation. As a result, GNS stakers are also hopeful for a price appreciation on the token.

It is equally important to note, as previously covered, that in the event of over-collateralization, the amount of DAI over the collateralized amount will be used to buy GNS from the GNS/DAI liquidity pool and burn it, creating a deflationary environment for the token. In the first full year of the protocol’s operations, the GNS token has had a net deflationary effect. This is yet another incentive for users to own and stake GNS.

GNS Token and GNS Native NFTs

As mentioned above, the GNS token is the main driver of the Gains Network ecosystem. Staking GNS gives users claim to the platform fees generated. At present, 40% of the fees from market orders and 15% of the fees from limit orders are allocated to $GNS stakers.

GNS also provides stakers with governance power. Users can propose protocol changes and vote on these changes by staking GNS. The more GNS staked, the more voting power.

Finally, users can stake Gains Network NFTs to earn staking boosts and fee reductions seen below.

Trade Settlement

In order to settle these synthetic trades, there must be a source of truth for reference. However, due to the nature of blockchain technologies, the nodes on each blockchain are limited and can only refer to the data on that specific blockchain. Gains Network uses Chainlink’s decentralized oracle network (DON) technology to solve this issue.

Decentralized oracle networks bridge the gap between blockchains and real world information. DONs are consolidations of real world data that securely interact with onchain nodes to provide the data in an agreed upon manner. In the case of Gains, DONs are used to reference asset prices from offchain sources (crypto prices on various networks, stock prices on market exchanges, etc.), using the median price from multiple sources at the time of settlement. This system provides the most accurate settlement price while also preventing unwanted order fills due to scamwicks.

Scamwicks are faulty asset prices caused by an exchange or user that triggers certain open orders, when in reality the true value of the token is not representative of that price fluctuation. This is common in crypto where markets are created by asset pools or centralized exchange order books.

Chainlink’s DON provides gTrade users a more efficient trading platform by providing the Gains Network nodes the most accurate settlement for user’s trades and ensures that high leverage trades will not be erroneously triggered as a result of faulty data.

Roadmap & Scalability

In addition to the creation of their roadmap, the team has laid out 5 points for their long-term vision:

gTrade becomes the most adopted decentralized leveraged trading platform.

Gains Network becomes a DAO governed by the $GNS token (or a derivative like $veGNS).

Create great DeFi products that bring revenue that can be distributed in a $GNS staking pool.

Development scales horizontally, any team can create governance proposals to receive funding from the governance and create cutting-edge products that bring revenue to $GNS holders.

Gains Network launches new products like its own casino and metaverse.

As of Q3 2022, Gains Network has completed the following items on its initial long-term roadmap.

Fully optimized website (UI/UX)

Optimized loading times and trading page performance

Open limit/stop orders

Develop top-tier UI/UX

Security

Bug bounty with ImmuneFi

CertiK Audits (https://www.certik.com/projects/gains-network)

Whitelabels, integrations, and partnerships

TokenTerminal Inegration (https://tokenterminal.com/terminal/projects/gains-network)

QuickSwap Whitelabel

Open source website

Release website frontend and documentation

Allows for creation of whitelabels and and local access

Introduction of more asset classes

Stocks

Commodities

Indices

Protocol owned liquidity

Single-sided GNS staking (10% of LP rewards)

While Gains Network has accomplished plenty in the past year, they are still planning on growth and expansion. Below are some items from the long-term roadmap that have yet to be achieved, along with their estimated dates of completion.

Increased protocol owned liquidity

20% of LP rewards sent to GNS staking (ETA Q4 2022)

80%+ of LP rewards send to GNS staking (ETA Q4 2023)

Custom market types

Cross pairs (ex. TSLA/DOGE, AAPL/BTC)

Custom indices (ex. 25% BTC, 25% ETH, 25% MATIC, 25% LINK)

ETA Q4 2022

Social features

User profile pages, trade sharing, trade following, etc.

Vault updates

Vault staking (ex. Staking DAI in the vault on AAVE to earn increased return)

Q4 2022

Zk rollup deployment

Instant trade execution and inheritance of security of Ethereum

ETA Q4 2022

Metaverse exploration

Exploring the possibility of trading directly from the metaverse

ETA Q1 2023

At the time of this report, Gains network was just successful in launching their v6.1 upgrade to the platform (July 2022). Following the successful update, the development team introduced the most recent version of the protocol roadmap and plans.

Technical progress (smart contracts)

v6.2 (ETA August 2022)

GNS staking for DAI rewards

Referral system

Price aggregator optimizations (use chainlink price feed to track LINK/USD for oracle costs)

v6.3 (ETA September 2022)

Custom chainlink oracles price lookback (guaranteed and exact execution of all limit orders)

NFT bot incentives optimizations

Easier on-chain tracking of fees generated (for stats dashboards)

v6.4 (ETA October 2022)

Allow increasing/decreasing the collateral of a trade

Partial take profits/stop losses

Vault Update

Allow staking other collaterals in the vault

Allow trading and receiving profits with other collaterals

ETA November 2022

The update also notes that they are continuing to grow the dev team, specifically software engineers and marketing personnel to grow awareness of the project, continue its advancement, and create a more efficient and user-friendly product.

In terms of scalability, the main way for GNS to grow is by the growth of their vault. The greater the size of the vault, the more volume they will be able to handle and the more liquidity efficient the protocol will be.

Tokenomics

The fuel for gTrade’s engine is the Gains Network native token, GNS. The GNS tokens acts as a mechanism of liquidity efficiency by allowing the protocol to capitalize on its resources and offer incentives for liquidity providing. The token also holds governance weight in the protocol.

The token initially started as the GFARM2 token on Ethereum. The token was fairly distributed in an ETH pool and a GFARM2/ETH LP pool. The dev fund and governance fund each received 5% of the token.

When Gains Network decided to move to Polygon in an effort to reduce trading fees, the token had a 1:1000 split to GNS.

Per the Gains Network team, in its present iteration the GNS token serves the following purposes:

Supports the liquidity of the DAI vault by minting rewards for GNS/DAI LP providers, NFT bots, and affiliates. This allows the DAI to remain in the vault to increase capital efficiencies by reducing vault drawdowns and supporting its over-collateralization.

When the DAI vault becomes sufficiently over-collateralized (offering a suitable buffer for DAI stakers - currently at 130%), the excess DAI is removed from the vault and swapped for GNS in a GNS/DAI liquidity pool. That GNS is then subsequently burned as a counter-inflationary measure.

Ensures that early adopters and supports will not have their percentage of platform interest diluted in future by new and larger investors

GNS acts as the ultimate backstop to the DAI vault - if traders are winning on gTrade, GNS will be sold OTC from the protocol wallet reserves to replenish the DAI in the vault and return to the appropriate collateralization percentage)

GNS is the main driver for protocol governance

Token Utility

The GNS token provides investors with 2 main utility features:

Provides investors with a claim to the fees generated on the protocol through single-sided staking

Provides investors voting power in governance proposals

Token Statistics

The below are token statistics as of August 2022:

Initial supply: 38,500,000 GNS

Max supply: 100,000,000

Current supply: 30,020,000 GNS

Total staked amount: 17,000,000 GNS

GNS Price (USD): $1.87

GNS Market Cap: $56,137,000

Competition & Risks

Gains Network’s main competitors are other, larger decentralized leveraged trading platforms. The protocol descriptions below are sourced from coinmarketcap.com.

dYdX

DYDX (dYdX) is the governance token for the layer 2 protocol of the eponymous non-custodial decentralized cryptocurrency exchange. It serves to facilitate the operation of layer 2 and allows traders, liquidity providers and partners to contribute to the definition of the protocol's future as a community.

Token holders are granted the right to propose changes on the dYdX’s layer 2, but unlike the GNS token there is no opportunity for dYdX holders to earn a portion of protocol fees.

https://dydx.exchange

GMX

GMX is a decentralized spot and perpetual exchange that supports low swap fees and zero price impact trades. Trading is supported by a unique multi-asset pool that earns liquidity providers fees from market making, swap fees, leverage trading (spreads, funding fees & liquidations) and asset rebalancing. Dynamic pricing is supported by Chainlink Oracles along with TWAP pricing from leading volume DEXs. For token holders: Tokenomics and Rewards For liquidity providers: GLP For traders: Trading

https://gmx.io/#/

Lyra (SNX)

Synthetix is a decentralized finance (DeFi) protocol that provides on-chain exposure to a wide variety of crypto and non-crypto assets. The protocol is was founded on the Ethereum (ETH) blockchain and offers users access to highly liquid synthetic assets (synths). They have since expanded to a number of popular layer 2 networks including Optimism. Lyra has built a Synths track and provide returns on the underlying asset without requiring one to directly hold the asset.

The platform aims to broaden the cryptocurrency space by introducing non-blockchain assets, providing access to a more robust financial market.

https://synthetix.io

As with any decentralized protocol, there are also risks involved with investment. Blockstar has identified the following risks as being most prevalent with Gains:

Traders win more than the DAI vault can cover. Despite the over-collateralization amount, there is always the risk that the winning trades will outweigh the losing trades + the collateral amount. Should this happen, the DAI vault could be diluted, forcing the protocol to sell GNS reserves to replenish the vault. This would create selling pressure on the token.

Protocol exploits. Despite increased and continually advancing security measures, there have been plenty of instances of protocol exploits in DeFi. If the protocol were to be hacked, the value of GNS would suffer.

Regulatory Scrutiny. It remains to be seen what regulators decide to do with decentralized finance. Until governing agencies provide greater clarity on DeFi protocols and tokens, regulatory scrutiny remains a main risk.

Potential Bank Run on DAI Vault. Similar to what we’ve seen with traditional bank runs, there is a risk of a bank run with the DAI vault, despite over-collateralization measures

Team, Partnership, &. Investors

The Gains Network team currently consists of 9 members - Seb, the head developer and founder of the project, 4 members of the software development team, and 4 members of the marketing team. As is common with many DeFi protocols at present, the team remains semi-anonymous to protect their identities. Most of the time, semi-anonymous teams will claim personal security reasons as to remain anonymous.

To give investors assurance against fraud when remaining anonymous, the protocol partners with crypto audit, attestation, and bounty firms. To date, Gains Network has partnered with ImmuneFi to identify potential exploits in the code, as well as CertiK, a protocol audit company. CertiK looks through Gains Network’s team, protocol code, and token wallets to create a trust score. After 8 audits performed by CertiK, Gains Network received a total trust score of 87/100 which by their measures is listed as “good”.

Key Metrics & Evaluation

To try and put a valuation on a developing project like Gains, it is best to look at the protocols key metrics and compare that to its competitors. We also monitor the growth of these key metrics to ensure that the protocol is continuing to develop. Below are some key metrics we follow for Gains (as of August 2022) and how these metrics stack up to its competition.

Number of gTrade users

Daily users: 141

Cumulative users: 5,790

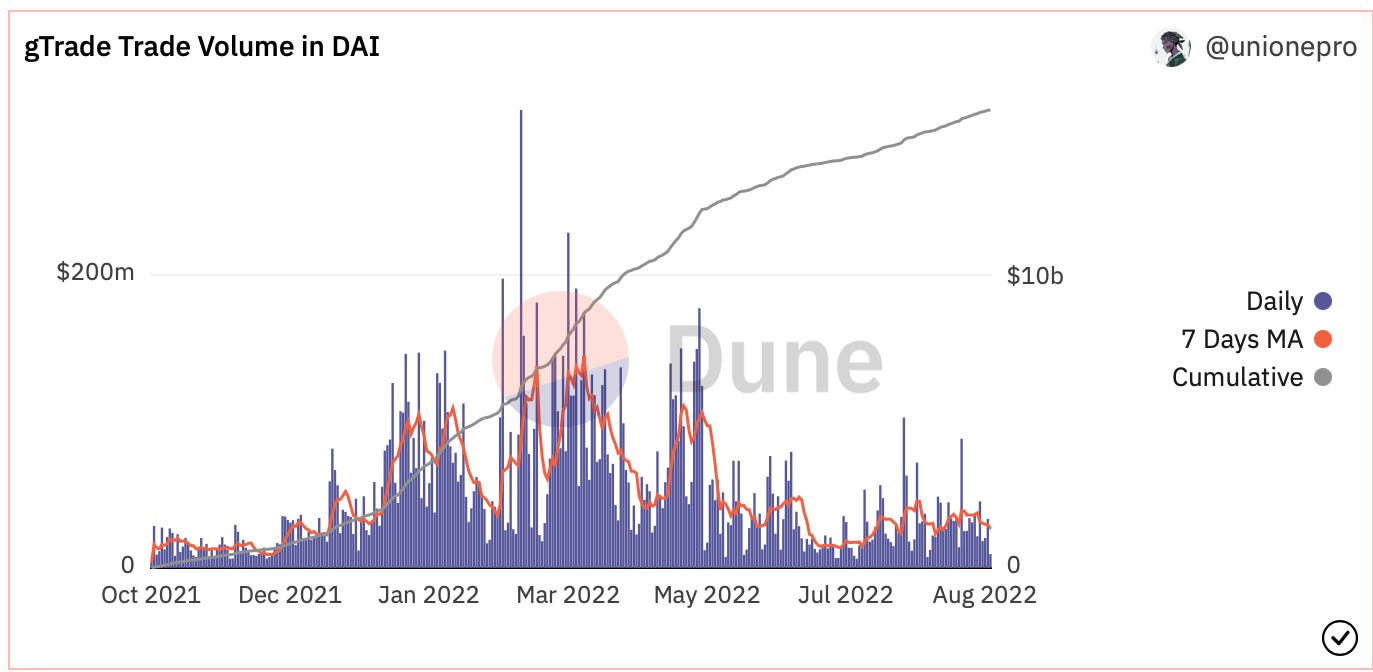

gTrade Volume (DAI)

Daily Volume (DAI): $20.45m

Cumulative Volume (DAI): $15.84B

gTrade Fees Breakdown

LP Stakers (DAI): $1.61k

GNS Stakers (DAI): $1.77k

Cumulative Fees (DAI): $12.07m

Liquidity Pool Size (TVL)

DAI Vault: $11.1m

GNS/DAI Pool: $7.27m

GNS Supply

Initial Supply: 38.5m GNS

Total Supply: 100m GNS

Current Supply: 30.02m GNS

GNS Price and Market Cap

Current Price: $1.87

Current Market Cap: $56.3m

Because each project is unique, it is difficult to compare each individual metric to other protocols. When considering the growth trajectory of each project, it is important to monitor all metrics. However, when comparing DeFi protocols at present, the most useful metrics for comparison are: users, cumulative fees earned, liquidity pool size, and market cap.

Cumulative Users

GMX: 71,060 (12.2x GNS)

dYdX: 63,915 (11.03x GNS)

Cumulative Fees to Stakers Earned

GMX: $57,420,869 (4.76x GNS)

dYdX: $0 (Strictly governance token)

Liquidity Pool Size (TVL)

GMX: $256,697,511 (23.12x GNS)

dYdX: $503,500,000 (69.26x GNS)

Market Cap:

GMX: $342,443,924 (6.08x GNS)

dYdX: $98,873,225 (1.75x GNS)

Disclaimer

The content in this report is purely information and should not be considered financial advice. Blockstar is a research firm and not a Registered Investment Advisor. Blockstar has no affiliation with the projects listed in this report.