Market Update: August 29, 2022

Bitcoin falls below $20k over the weekend, Powell warns of increased inflation, Grayscale discloses SEC queries, India's crypto market growing - despite harsh warnings

Crypto investors are bracing themselves for more turbulence this week following the fallout from Fed Chairman Powell’s remarks last weekend, particularly on inflation. In theory, Bitcoin should act as a hedge to inflation, however due to the still speculative nature of the asset class, many investors dump the digital asset in an effort to become more risk averse. Investors should be monitoring certain technical levels and major news stories this week as Bitcoin looks to hold above $20,000.

Key Takeaways:

BTC fell below $20k over the weekend as Powell remained hawkish at the Fed’s Jackson Hole Summit

Grayscale opens up on SEC queries offering insight into what the governing body may consider to be securities

The number of crypto investors is growing in India despite warnings from the Central Bank Governor

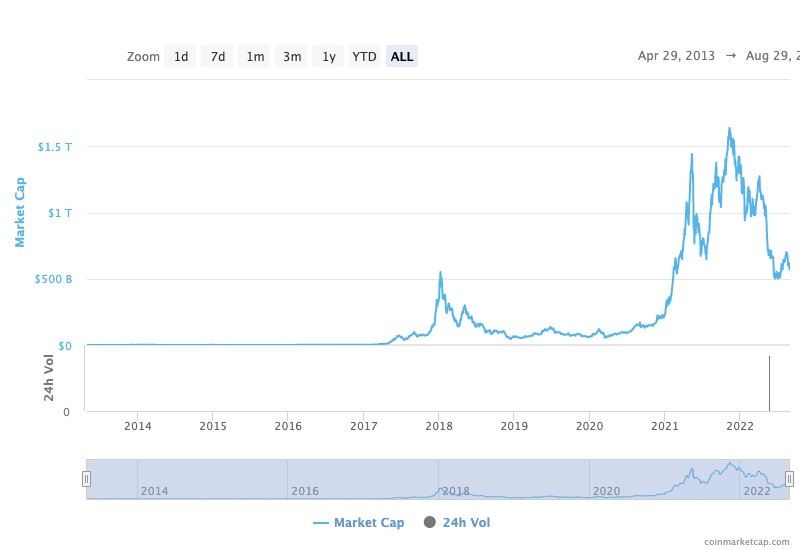

Total Crypto Market Cap (CoinMarketCap): $945B (-6.25% 7d)

Total Crypto Market Cap Ex-BTC (CoinMarketCap): $569B (-2.4% 7d)

Powell Remains Hawkish, BTC sells off

Fed Chairman Powell remained hawkish in his comments over the weekend at the Fed’s Economic Symposium in Jackson Hole, WY. Powell hinted increased inflation over the coming months and a federal funds rate of 2.25-2.5% in the longer term. In theory, this should be good news for Bitcoin, as its finite supply should act as an inflationary hedge against fiat currencies. However, digital asset investors at present treat Bitcoin as a speculative asset that trades more like a technology stock than a commodity like gold. Both the NASDAQ and BTC fell around 3.5% following Powell’s comments. It remains to be seen when BTC will break this trend of trading with tech stocks, but for the moment we can expect the finite supplied digital asset to follow tech’s lead.

Key Support/Resistance Levels:

Support levels: $20,193.88, $19,737.03, $18,918.81

Resistance levels: $21,468.85, $22,286.97, $22,743.82

14 day RSI at 50%: $22,539.22

14 day RSI at 30%: $18,872.86

Price crosses 40d MA: $22,316.40

Grayscale Discloses SEC Queries

Grayscale revealed last week that they have been questioned regarding some of their digital asset holdings, specifically from the SEC in regards to which tokens may be defined as securities. Grayscale, a digital asset investment firm with billions worth of BTC and ETH, hold positions in ZEC, ZEN and XLM as well, however these positions only amount to ~$40million of Grayscale’s assets under management. Nonetheless, the SEC has made it a point to look more into digital assets in an effort to define what should be regulated by their governing body. While regulation is welcome within the industry, uncertainty regarding that regulation in the short to near term can create increased volatility in the crypto markets.

ZEC: $63.14 / 24h: +1.95% / 7d: +1.86%

ZEN: $15.63 / 24h: +1.03% / 7d: -4.13%

XLM: $0.1041 / 24h: -1.47% / 7d: -4.07%

India’s Crypto Market is Growing

A new report from KuCoin showed that India has roughly 115 million crypto investors, which accounts for roughly 15% of the overall population. While this may not seem like much, it is a potentially bullish signal for a country currently experiencing and economic downturn. The KuCoin report also states that more than half of these crypto investors plan to increase their digital assets investments within the next 6 months.

The report goes on to note that in a country of 1.4 billion people, India is well positioned to become a key cryptocurrency hub with a large portion of their population focused on technology and fintech.

Despite recent regulatory changes on digital assets in India, mainly a 30% tax on income received from digital assets as well as increasing regulatory frameworks, KuCoin estimates the Indian crypto market will grow to $241 million by 2030. With all the technological advancements in that region of the world, India remains a country to watch for crypto adoption and technological advancement.

Other Crypto News

GammaX Raises $4M for Crypto Derivatives Solution on Ethereum Layer 2 (Decrypt): https://decrypt.co/108460/gammax-raises-4m-launch-crypto-derivatives-exchange-ethereum-layer-2-solution

Bitcoin and Ether sell of with Traditional Financial Markets (Decrypt): https://decrypt.co/108452/bitcoin-ethereum-drop-as-traditional-markets-skid-into-new-week

Polkadot Parachain Moonbeam Integrates Cross-Chain Messaging Protocol LayerZero (CoinDesk): https://www.coindesk.com/business/2022/08/29/polkadot-parachain-moonbeam-integrates-cross-chain-messaging-protocol-layerzero/

Crypto ATM Company Bitbase Prepares to Open Operations in Venezuela This Year (Bitcoin.com): https://news.bitcoin.com/crypto-atm-company-bitbase-prepares-to-open-operations-in-venezuela-this-year/