Synthetix Network (SNX) has gained attention recently after it made a huge move off the bottom and certified itself as one of the top crypto projects by fees collected. In June alone, the fees collected on Ethereum by Synthetix rose from $4,000 on June 1st to a peak of about $9.60M. This led to the SNX token doubling in price, hitting a high of over $3.

What is Synthetix Network Token

Synthetix Network is a decentralized synthetic asset issuance and exchange (DEX) protocol that initially launched in September 2017 under the name Havven and was founded by Kain Warwick. They rebranded to Synthetix in late 2018, expanding their offerings to include a variety of synthetic assets beyond USD including different fiat currencies, commodities, indexes, and other cryptocurrencies. These synthetic assets or "synths" track prices through Chainlink oracles, allowing users to gain all of the benefits of holding a particular asset without actually holding it. This allows users to gain exposure to the underlying asset while benefitting from all of the advantages of decentralization. All synths start with "s", so a USD synth would be displayed as sUSD. The Synthetix protocol also includes a DEX where these synths can be swapped without requiring a counterparty to hold the synth being swapped for. This is because the smart contract burns the input synth and mints the corresponding value of the output synth.

How Synthetix Works

The SNX token is used as collateral to mint synths. Users can stake SNX in a smart contract and mint synths against it. The amount of synths that can be minted is dependent on the collateralization ratio (c-ratio), which currently sits at about 270%. Therefore, users must lock 2.7 times more value of SNX than the value of synths they mint. Whenever a new synth is minted, the staker creates a debt that changes with the exchange rate. Stakers must pay back this debt before they can withdraw their staked SNX. By staking, users receive a percentage of the protocol's trading fees in sUSD along with SNX rewards from inflation. Stakers who actively maintain the collateralization state receive a greater percentage of trading fees.

Recent Events

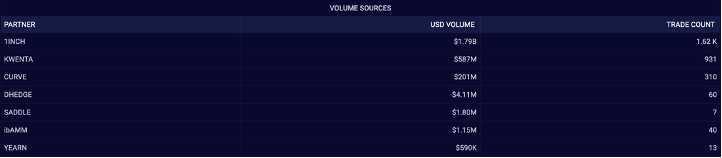

As seen in the first chart, Synthetix recently rose to the top of the leaderboards for fees generated by crypto projects. The massive increase in trading volume comes mostly from the DEX aggregator, 1inch, after SIP-120 proposal was passed. SIP-120 implemented atomic swaps, which eliminated the ten-minute waiting period for swapping synths and was integrated by 1inch. Synthetix now uses Uniswap V3 as a secondary price oracle, and users can swap synths on Ethereum mainnet automatically without fee reclamation. This was already a feature on the Ethereum L2 Optimism, but the atomic swaps on mainnet served as a major catalyst for this increase in trading volume. As Kain Warwick explained, “After some further work to improve execution efficiency and coordination with integrators, 1inch began routing orders through Curve+Synthetix and volume took off.” 1inch is currently the only protocol that has integrated atomic swaps, but the Synthetix team is working towards forming additional partnerships that will help bring in even more trading volume.

In March, Synthetix launched perpetual futures on their synths, which was integrated by the protocol, Kwenta, and also contributed to this surge in trading volumes.

Kain Warwick has recently been extremely vocal on Twitter, correctly predicting that Synthetix will pass Bitcoin in daily fees generated. He also put out a proposal (SIP-254) that incentivizes the trading of perps on Optimism by diverting 20% of the weekly SNX inflation, which he hopes will contribute towards higher fee generation.

Closing Thoughts

Every DeFi protocol has its risks and Synthetix is no different. Although Synthetix is currently overcollateralized, it can still implode if SNX crashes since staked SNX acts as collateral. The protocol relies on stakers to pay down their debt to maintain the network c-ratio while absorbing potential liquidations. That being said, Synthetix has been able to survive for four years and their overall health can be easily monitored. Despite falling over 90% from its highs, none of the top 20 wallets have been liquidated. Since debt decreases when the price of ETH and BTC fall, this can provide some safety in a bear market. Also, the largest holder of SNX and protocol debt, the community treasury, is dedicated to servicing its debt, which can help protect smaller wallets.

Synthetix has already made moves to protect the protocol from SNX falling in value with the SIP-148 proposal. This changed the liquidation mechanism to reduce the chances of cascading liquidations, commonly referred to as a death spiral, while incentivizing existing stakers to act in the best interest of the protocol.

With the increase in trading volume, this helped increase staking yields from fee generation, which can be used to pay off debt and maintain confidence in the health of the protocol. If Synthetix can continue making moves to form additional partnerships that help increase fee generation, it will survive the bear market and appease their stakers. Given the current market conditions, SNX will fall if the overall market continues its bear market. However, by surviving this crash, Synthetix will solidify itself as one of the top DeFi protocols. Currently, the staking yield is over 80% APY paid in their stablecoin sUSD, and will continue to increase with greater fee generation. Once the market turns around, staking SNX could be one of the best investment opportunities in crypto.

Written by: Zachary Rampone

@nfthunter131 on Twitter